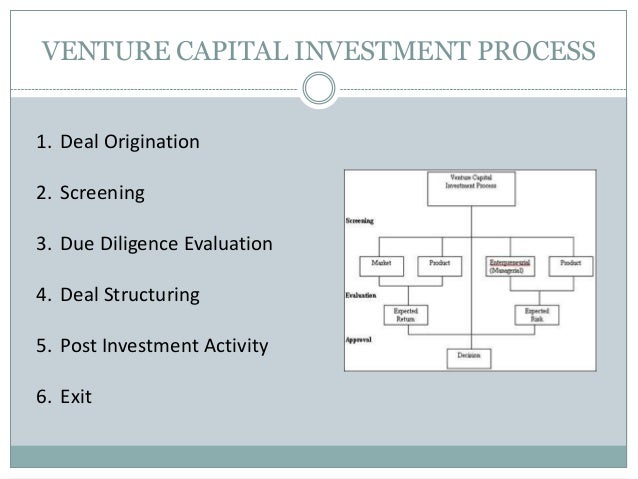

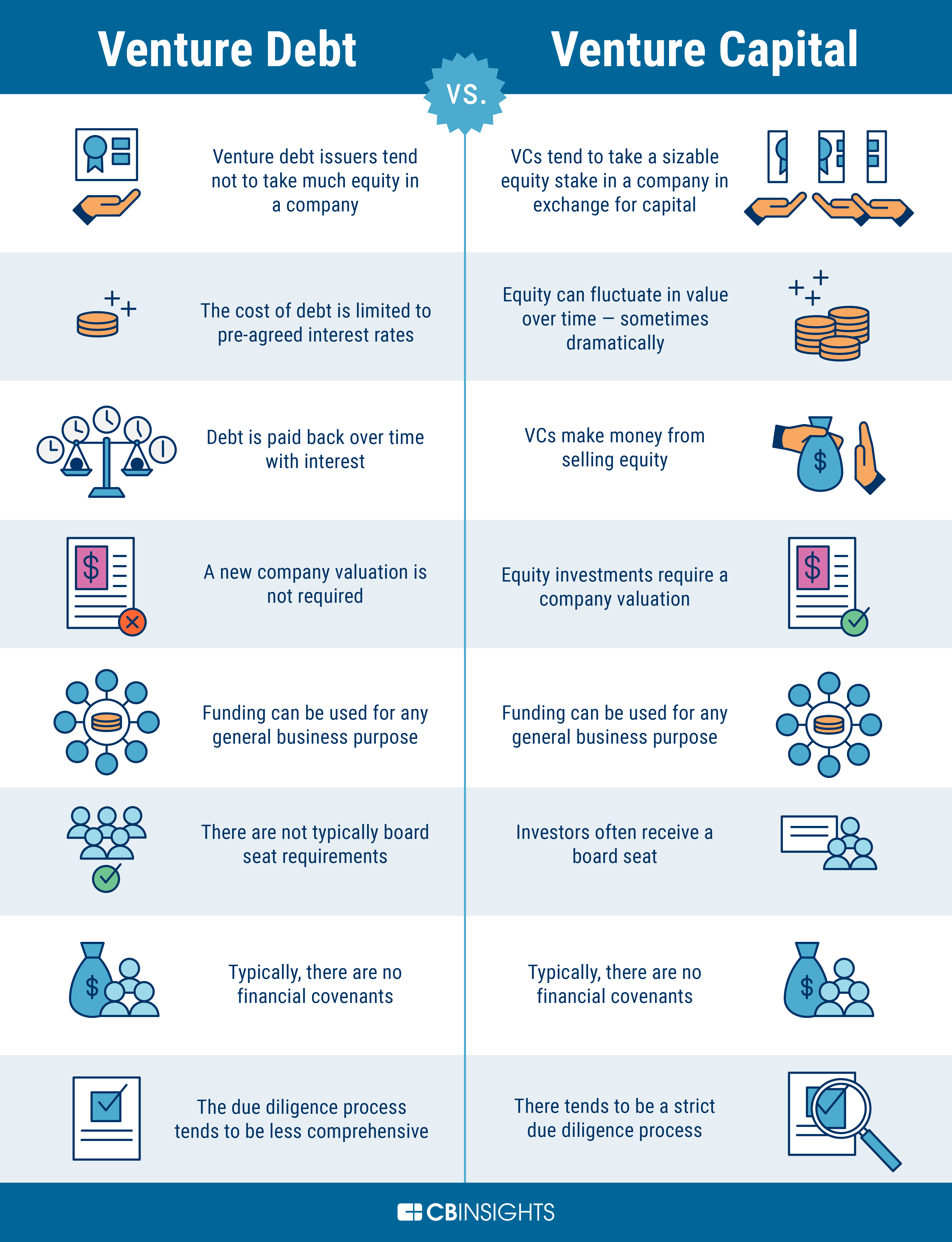

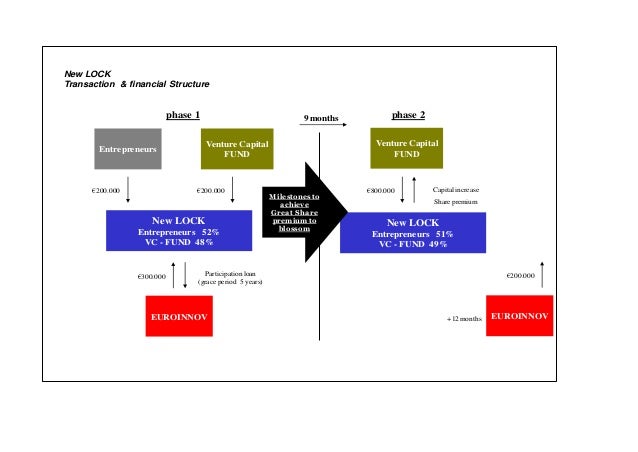

This course introduces the history of venture capital, fund structures, various roles in VC, early-stage financial instruments, and term sheets. Over 1 hour (30+ lessons) can be completed in less than 1 week Overview GPs are busy and may not have time to teach you, so EntryLevel fast-tracked my process."įree Venture Capital crash course by Wall Street Oasis Cost Johnpaul, a student enrolled in the Venture Capital Analyst course, shared a testimonial about the program: "My portfolio got me a job…EntryLevel helped me level up. Upon completion, participants possess a portfolio showcasing their abilities. The curriculum covers Venture Capital fundamentals, the GP-LP relationship, startup essentials, the Power Law Curve, market and trend analysis, evaluating companies, and breaking into the industry. Participants collaborate with up to 30 peers, earning badges by completing tasks. The program covers the inner workings of Venture Capital funds, market analysis, startup sourcing, due diligence, and insights from industry experts.

EntryLevel's Venture Capital course equips participants with essential knowledge and skills for this field. Venture Capital Analysts play a vital role in connecting with startups, identifying investment opportunities, and delivering value. You pay first, but you only get the refund when you complete the course by the deadline (to motivate you to reach your learning goals).6 weeks might be too long - or too short - of a course duration for some students.You get the certificate even if you opt for the refund (free certificate).You work on real-world projects and complete the course with a Venture Capital Analyst portfolio of work.Flexible, online course with deadlines so there is some structure.Course created by experts which you get to learn from.Insights from real-world venture capital analysts and fund managers on breaking into the field.This certified venture capital course covers: Participants will work on an investment memo and gain practical experience throughout the course. OverviewĮntryLevel’s Venture Capital Analyst course is a flexible and hands-on program focusing on various venture capital and startup investment aspects.

The course can be completed within 6 weeks.

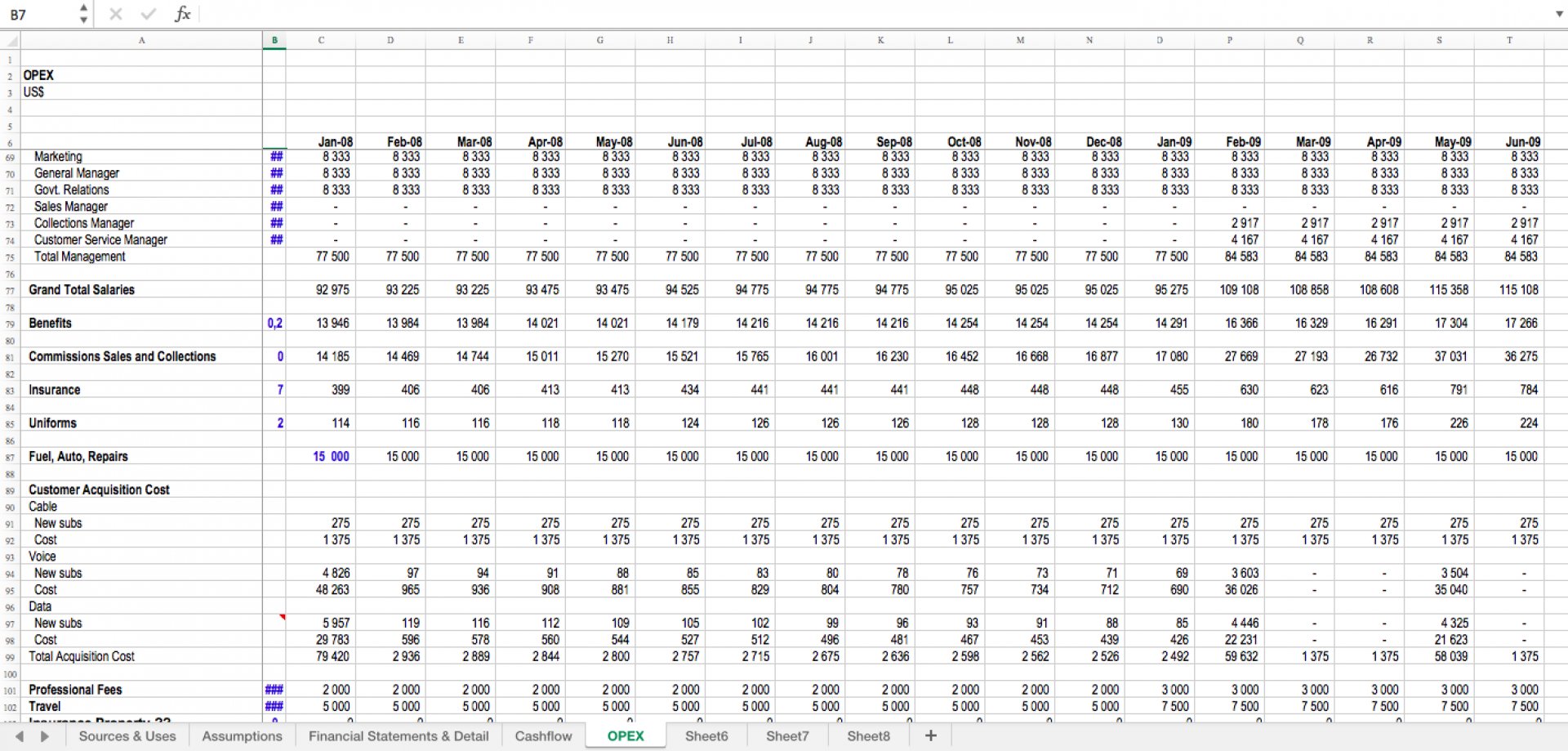

#Venture capital fund model excel free#

The course is free if completed within the given timeframe, with students paying upfront and receiving a refund upon successful completion. Venture Capital Analyst beginner course with certification Cost

Read more: Breaking into Venture Capital Part 2

0 kommentar(er)

0 kommentar(er)